- +91-8898979393

- +91-8652519622

- process@vslegalindia.com

- B 005/006 Surya Kiran Building, Awadhut Nagar, Near Anand Juice Center, Dahisar East, Mumbai, Maharashtra, 400068

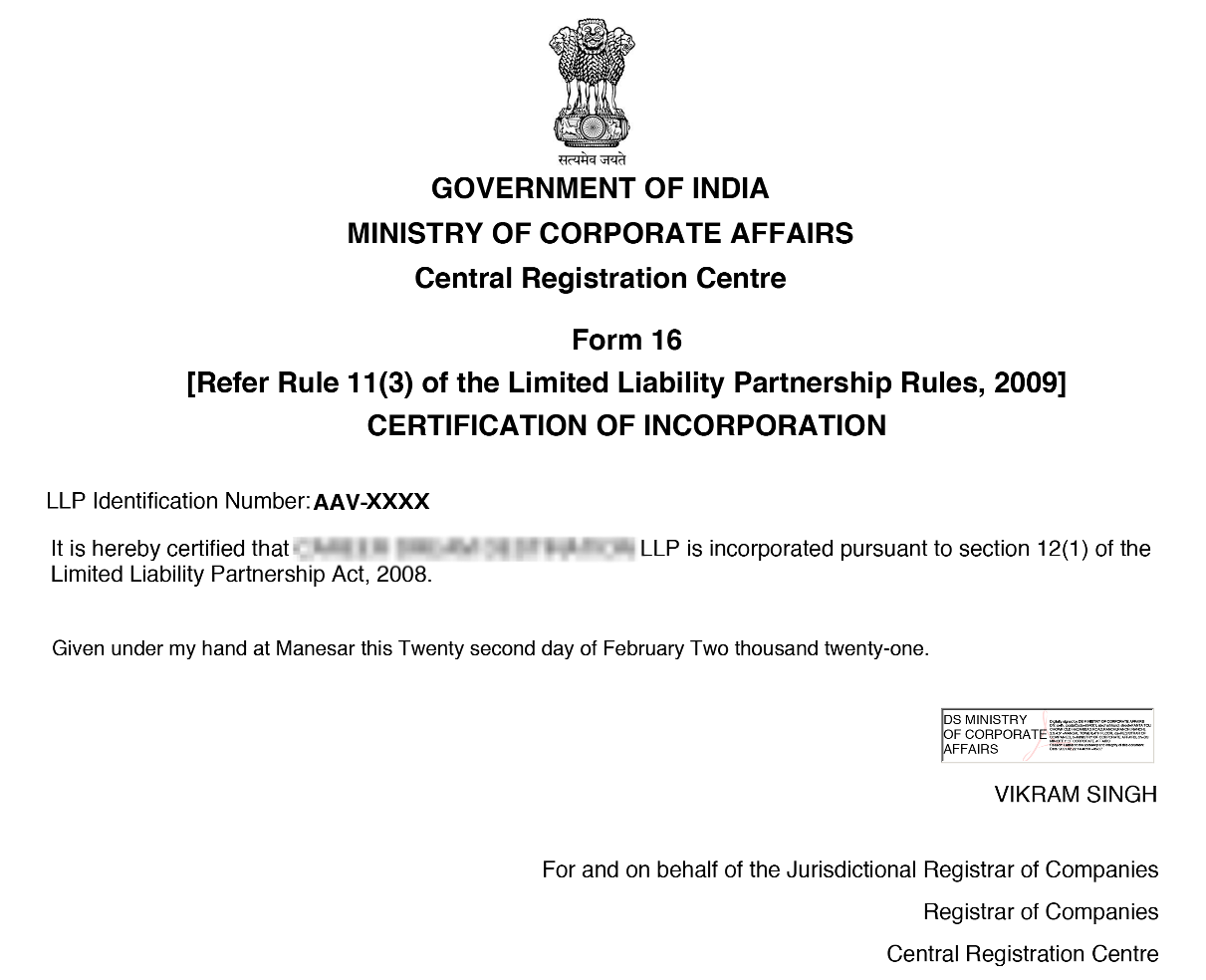

LLP is an Incorporated Partnership Firm registered under Limited Liability Partnership Act, 2008 with limited liability and has a perpetual succession.

LLP is a hybrid between a Company and Partnership Firm. The LLP is a separate legal entity, where no partner is liable for unauthorized the action of the other partners and liability of the partner is restricted to this own Contribution and LLP is flexible in structure & operation in management, due to flexibility in structure and operation in management, LLP is suitable for small enterprises. Unlike a Private Limited Company, the Partner of LLP have the right to manage the business.

LLP agreement describes the Roles, Rights, Duties, Responsibilities and Liabilities of the Partners.

If you want to register your Limited Liability Partnershipthan VS IPR & LEGAL ADVISORS will help you in Registration and all the Compliance after Registration.

Re-engineer the wisdom to create wealth. Innovation & quality is our hallmark and service to client, is our broader goal.

B 005 Surya Kiran building, Awadhut nagar near anand juice center Dahisar east Mumbai 400068, maharshtra

+91 8898979393

process@vslegalindia.com