- +91-8898979393

- +91-8652519622

- process@vslegalindia.com

- B 005/006 Surya Kiran Building, Awadhut Nagar, Near Anand Juice Center, Dahisar East, Mumbai, Maharashtra, 400068

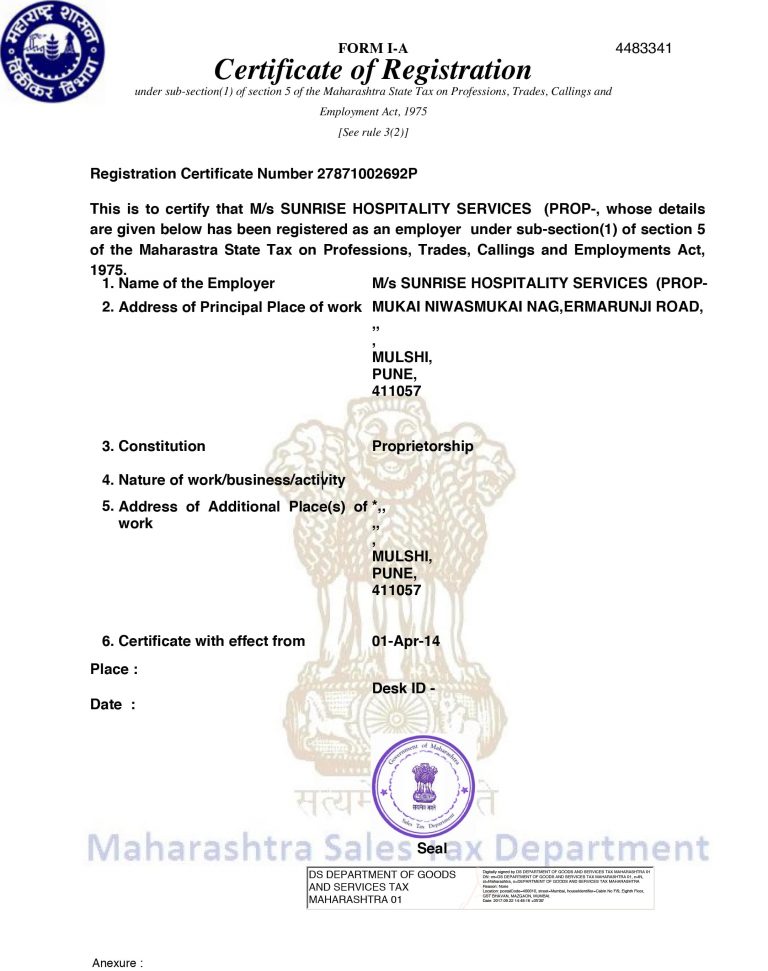

Professional tax is one that is levied on all professions, forms of employment, and trade. The tax is not restricted to professionals alone and is collected based on the individual’s income. Therefore, employees, individuals who own businesses and even professionals are taxed under this umbrella term if their income exceeds a threshold. As per Article 246 of the Indian Constitution, the Parliament is the only body that can alter laws related to tax on profits. The professional tax, however, is levied by State Governments, and hence, they have the right to make laws about it. Article 276 of the Indian Constitution deals with tax on employment, professions, and trade.

You will never have to deal with all your tax-related issues on your own again. Since you have tax professionals helping you with your tax-related work, you will never be alone again when it comes to your tax woes!

The relief which will help you reduce the amount you owe the government. Such firms evaluate your condition and then work out ways to help you reduce your penalties and fines.

In certain extreme cases, people end up losing their homes and other features due to their inability to pay their tax. When you work with a professional tax relief firm, you can ensure that this does not happen. They will work out ways for you to escape such situations and avoid such unfortunate incidents.

While these are the significant benefits that working with such firms provide, there are several other benefits too. Here’s a look at some of the other benefits they provide.

· Avoid having your account levied

· Stop tax wage garnishment

· Settle all your outstanding tax debt

· Make sure you don’t get caught up on past returns

· Assist with audits

· Avoid loss of credit score due to unpaid dues

· Enjoy more peace of mind

· Protection of Assets and Income

· Helps you interpret Tax Laws

Explains to you all the IT processes

Since the Professional tax is levied by various State Governments, every state has its own laws. However, every state follows a slab format for collecting Professional tax. As per Article 276, State Governments can levy Professional tax up to INR 2,500.

| Up to INR 7,500 (Men) | NIL |

| Up to INR 10,000 (Women) | NIL |

| INR 7,500- INR 10,000 | INR 175/month |

| Above INR 10,000 | Normal months – INR 200/month February- INR 300 |

| Up to INR 8,500 | NIL |

| INR 8,500-INR 10,000 | INR 90/month |

| INR 10,000-INR 15,000 | INR 110/month |

| INR 15,000-INR 25,000 | INR 130/month |

| INR 25,000-INR 40,000 | INR 150/month |

| Up to INR 1.5 Lakhs | NIL |

| INR 1.5 lakhs- INR 1.8 lakhs | INR 125/month |

| Above INR 1.8 lakhs | INR 212/month |

| If tax liability during the previous year or part thereof was less than Rs. 1,00,000 | Annual return on or before 31st March of the year ( for salary paid for the months from 1st March (of immediately preceding year ) to 28th February ( of current year)) |

| Rs. 1 Lakh or more | Monthly Returns on or before the last day of the month (covering salary paid for the immediately preceding month). |

Re-engineer the wisdom to create wealth. Innovation & quality is our hallmark and service to client, is our broader goal.

B 005 Surya Kiran building, Awadhut nagar near anand juice center Dahisar east Mumbai 400068, maharshtra

+91 8898979393

process@vslegalindia.com