LEI Registration

Google Customer Rating

4.9

Get Expert Consultation

LEI REGISTRATION

“LEIL has been recognized by the Reserve Bank of India as an “Issuer” of Legal Entity Identifiers under the Payment and Settlement Systems Act 2007 (as amended in 2015).” LEIL has been Accredited by the Global Legal Entity Identifier Foundation (GLEIF) as a Local Operation Unit (LOU) for issuance and management of LEI’s.

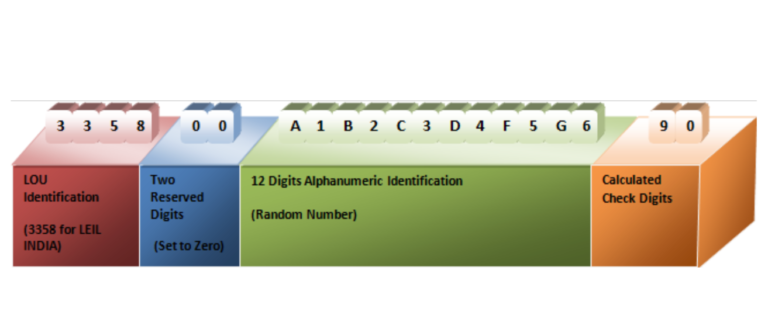

The Legal Entity Identifier (LEI) is a global reference number that uniquely identifies every legal entity or structure that is party to a financial transaction, in any jurisdiction. LEIL will assign LEIs to any legal identity including but not limited to all intermediary institutions, banks, mutual funds, partnership companies, trusts, holdings, special purpose vehicles, asset management companies and all other institutions being parties to financial transactions. LEI will be assigned on application from the legal entity and after due validation of data. For the organization, LEI will is important for promoting transparency, efficiency, and security in financial markets.

Business loans

Risk management

Regulatory oversight

What is the LEI code?

What is the purpose of LEI?

The purpose of the LEI is, therefore, simple: it helps you to recognize legal entities on a globally accessible database. This results in more security around international transactions, shortcuts to Know Your Customer (KYC) processes, and boosting transparency throughout the global financial system.

A company’s LEI record contains public data such as its name, address, registered address, and whether it is a branch or owned by another parent company. The LEI Register India’s search tool allows you to access the database.

GOVERNMENT FEES

| S.No. | Multi-Year Contract Option | SEZ (Fees + 18% GST) | Non SEZ (inclusive of 18% GST) | Total Fees |

|---|---|---|---|---|

| 1 | 2 years – New application & Renewal for next 1 year | 7,100 | 7,100 + 1,278 | 8,378/- |

| 2 | 3 years – New application & Renewal for next 2 years | 9,750 | 9,750 + 1,755 | 11,505/- |

| 3 | 4 years – New application & Renewal for next 3 years | 12,350 | 12,350 + 2,223 | 14,573/- |

| 4 | 5 years – New application & Renewal for next 4 years | 14,750 | 14,750 + 2,655 | 17,405/- |

Contact

Contact Us

Contact Us

let's talk!

Call us today, leave a message, email or find your nearest office below.

address

B-005 & 6 Surya Kiran Building, Awadhut Nagar, Near Anand Juice Center, Dahisar-East, Mumbai 400068, Maharashtra.

Contact

Contact Us

Contact Us

let's talk!

Call us today, leave a message, email or find your nearest office below.

address

B-005 & 6 SURYA KIRAN BUILDING, AWADHUT NAGAR, NEAR ANAND JUICE CENTER, DAHISAR-EAST, MUMBAI 400068, MAHARASHTRA.