Nidhi Company Registration

Google Customer Rating

4.9

Get Expert Consultation

Nidhi Company Registration

Nidhi is a Hindi word that means Finance or Fund. Nidhi Company are an Unlisted Public Limited Company and its sole objective is to cultivate the habit of thrift and savings amongst its members, receiving deposits from, and lending to, its members only, for their mutual benefit, and which complies with such rules as are prescribed by the Central Government for regulation of such class of companies.

If you want to start your business in the Finance sector then it is best option for you as it has a similar feature to NBFC and may even upgrade your company at a later stage into NBFC and then into a BANK.

If you want to register your NIDHI COMPANY than VS IPR & LEGAL ADVISORS will help you in Registration and in all the Compliance after Registration.

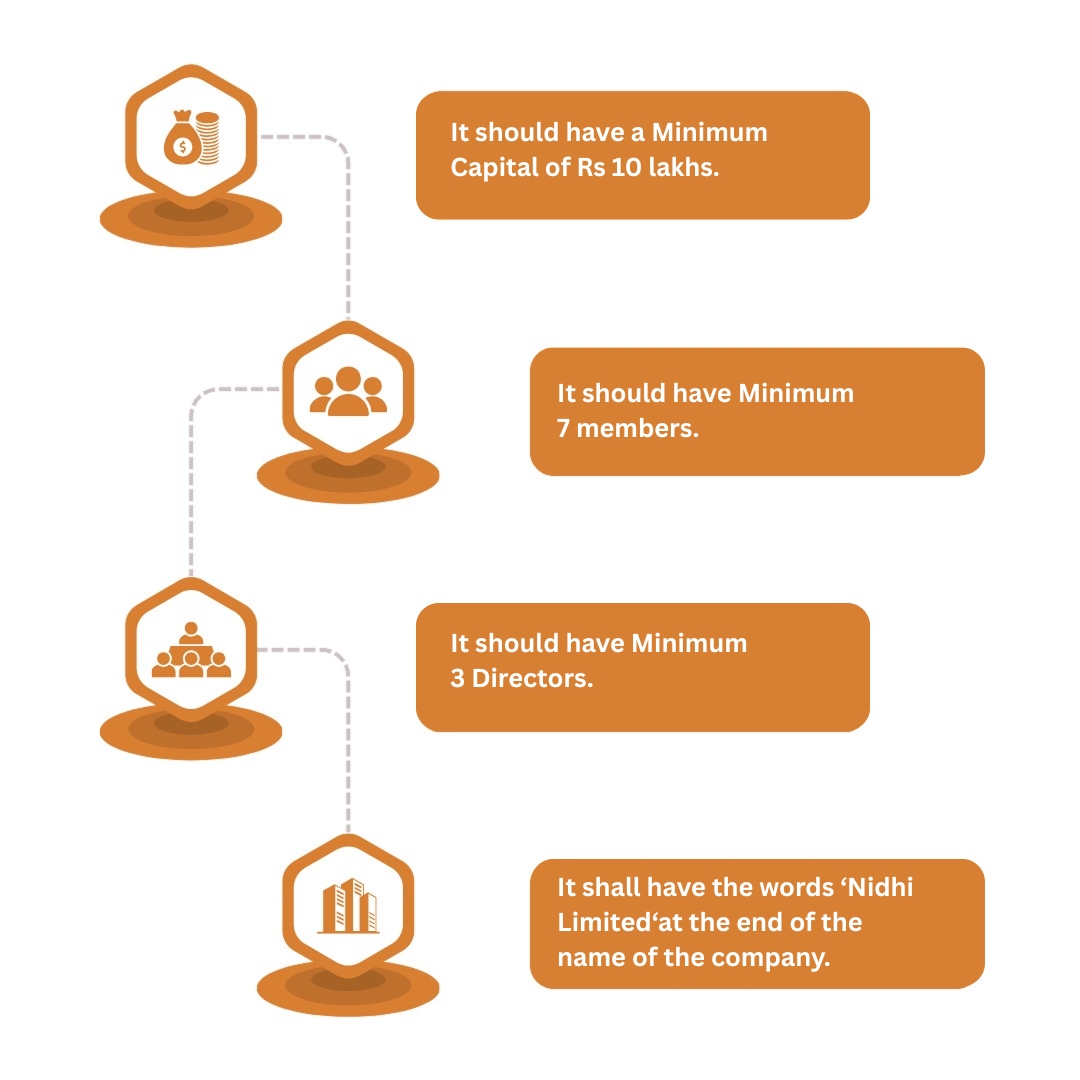

Analysis on Nidhi Company

- It should have a Minimum Capital of Rs 10 lakhs.

- It should have Minimum 7 members.

- It should have Minimum 3 Directors.

- It shall have the words ‘Nidhi Limited‘at the end of the name of the company.

ANNUAL COMPLIANCES AFTER INCORPORATION

| 1. |

Form NDH-1 (Return of statutory compliances) |

Within 90 days from the close of the first financial year (and every year thereafter) | Contains information about members, deposits, loans, reserves, etc. |

| 2. | Form NDH-2 – Application for extension to comply with requirements under Rule 5 (if conditions of minimum members, NOF, or deposits are not met). | Within 30 days from the close of the first financial year. | |

| 3. | Form NDH-3 (Half-yearly return) | Within 30 days from the conclusion of each half year (i.e. by 30th April and 30th October). | Contains details of members, deposits, loans, etc. |

| 4. | Form NDH-4 (Application for declaration as a Nidhi Company and updating status) | Within 120 days from incorporation or as notified by MCA. | Ensures compliance with all operational and financial parameters. |

| 5. | Form AOC-4 (Filing of Financial Statements – Balance Sheet, Profit & Loss, Auditor’s Report) | Within 30 days from the date of the Annual General Meeting (AGM). | |

| 6. | Form MGT-7 (Filing of Annual Return with details of shareholders, directors, etc.) | Within 60 days from the date of the AGM. | |

| 7. | DIR-3 KYC (Annual KYC of each Director using their DIN) | 30th September every year. |

General Restrictions or Probhitions

-

NO NIDHI Company can carry on the business of Chit Fund, Hire Purchase Finance, Leasing Finance, Insurance or Acquisition of Securities issued by any Body-corporate; issue preference shares, debentures or any other debt instrument by any name or in any form whatsoever; Open any current account with its members; Acquire another company by purchase of securities or control the composition of the Board of Directors of any other company in any manner whatsoever or enter into any arrangement for the change of its management, unless it has passed a special resolution in its general meeting and also obtained the previous approval of the Regional Director having jurisdiction over such Nidhi. Carry on any business other than the business of borrowing or lending in its own name. Issue or cause to be issued any Advertisement in any form for soliciting deposit. Private circulation of the details of fixed deposit Schemes among the members of the Nidhi carrying the words for private circulation to members only shall not be considered to be an advertisement for soliciting deposits.

-

Ratio of net owned funds to deposit shall be not more than 1:45.

-

Unencumbered term deposits of not less than 10% of the outstanding deposits as specified in Rule 14.

-

Net owned funds shall be Rs.10,00,000/- or more (Net owned funds means the aggregate of paid-up equity share capital and free reserved as reduced by the accumulated and intangible assets appearing in the last audited balance sheet).

BENEFITS OF NIDHI COMPANY REGISTRATION IN INDIA

1

2

3

4

5

6

7

8

FREQUENTLY ASKED QUESTIONS (FAQS) ON NIDHI COMPANY RESTRICTIONS

Can a Nidhi Company lend money to non-members?

A Nidhi Company is strictly allowed to lend or borrow funds only from its registered members. Any transaction with non-members is prohibited under Nidhi Rules, 2014.

Can a Nidhi Company advertise for deposits?

Nidhi Companies are not allowed to issue advertisements inviting the general public to deposit money. They can accept deposits only from members.

Can a Nidhi Company do microfinance or investment business?

A Nidhi Company cannot engage in microfinance, insurance, hire purchase, leasing finance, or NBFC activities. It functions solely as a mutual benefit society for its members.

How many districts can a Nidhi Company operate in?

Initially, operations are restricted to one district only. To expand into another district, the company must obtain prior approval from the Regional Director

Can a Nidhi Company issue preference shares or debentures?

A Nidhi Company cannot issue preference shares, debentures, or any debt instruments. Its funding is limited to members’ contributions and deposits.

What is the deposit limit for a Nidhi Company?

A Nidhi Company can accept deposits up to 20 times its net owned funds (NOF), ensuring financial stability and protection of member interests.

Can members open current accounts in a Nidhi Company?

Members can only open savings or recurring deposit accounts. Current accounts are not allowed.

What happens if a Nidhi Company violates these rules?

Non-compliance may lead to regulatory penalties, cancellation of Nidhi status, or actions under the Companies Act, 2013

Documents Required for Nidhi Company

PAN CARD

AADHAR CARD

BANK STATEMENT AND ELECTRICITY BILL AND TELEPHONE BILL (LATEST)

proof of registered office address

DRIVING LICENCE OR VOTER ID OR PASSPORT

LIST OF SUBSCRIBERS TO THE MOA AND AOA

LIST OF SUBSCRIBERS TO THE MOA AND AOA

2 PASSPORT SIZE PHOTO

LIGHT BILL

Contact

Contact Us

Contact Us

let's talk!

Call us today, leave a message, email or find your nearest office below.

address

B-005 & 6 SURYA KIRAN BUILDING, AWADHUT NAGAR, NEAR ANAND JUICE CENTER, DAHISAR-EAST, MUMBAI 400068, MAHARASHTRA.