Startup India Recognization

Google Customer Rating

4.9

Get Expert Consultation

Startup India Recognization

Startup India is an initiative of the Government of India to boost the Indian economy, encourage entrepreneurship and generate large-scale employment opportunities. The Government through this initiative aims to empower Startups to grow through innovation and design.

Through VS IPR & LEGAL ADVISORS avail various resources to manage & grow your Business plus a Start-up-India Recognization Certificate by Registering your Company / LLP / Registered partnership firm under Start-up-India.

Benefits Of Startup India Scheme

1

2

3

4

5

6

7

8

9

10

11

12

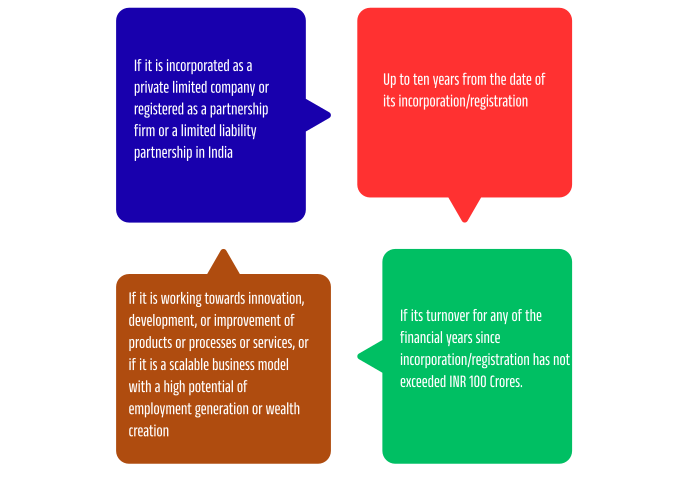

ELIGIBILITY CRITERIA FOR STARTUP INDIA CERTIFICATE

If it is incorporated as a private limited company or registered as a partnership firm or a limited liability partnership in India

Within a period of up to ten years from the date of its incorporation or registration, the entity shall remain valid and operational.

A business focused on innovation, improvement, or scalability with high potential for employment and wealth creation.

If its turnover in any financial year since incorporation or registration has never exceeded INR 100 Crores, it qualifies accordingly.

Note: An entity formed by splitting up or reconstructing a business already in existence shall not be considered a ‘Startup’.

Document requirements for Startup India Registration

Conclusion

Contact

Contact Us

Contact Us

let's talk!

Call us today, leave a message, email or find your nearest office below.

address

B-005 & 6 SURYA KIRAN BUILDING, AWADHUT NAGAR, NEAR ANAND JUICE CENTER, DAHISAR-EAST, MUMBAI 400068, MAHARASHTRA.